The Financial Conduct Authority's (FCA) new Consumer Duty regulation aims to create a higher standard of care for consumers. What does this mean to UK motor retailers and repairers?

Most dealerships distribute financial products to enhance vehicle sales. Under the new regulation, dealerships must evidence their Consumer Duty actions to ensure they meet the FCA's higher standards and expectations.

However, with fewer vehicle sales and changes in customer behaviour, Consumer Duty is an opportunity for automotive firms to build loyalty and drive profitability by exceeding regulatory requirements.

Putting the customers' needs first is the cornerstone of the Consumer Duty Principle. Here we look at what it means for those in the retail motor sector, whether online or in the showroom.

What is the FCA's Consumer Duty?

The regulation comprises three key components:

Firstly, an overarching Consumer Duty Principle sets a higher standard of care that the FCA expect companies to adhere to, evidencing their actions to deliver good client outcomes.

Secondly, the FCA has defined three cross-cutting rules that set out the standards of conduct expected across all areas of a firm's retail financial services activities, including:

-

- Act in good faith.

- Avoid foreseeable harm.

- Enable and support them to pursue their financial objectives.

Third and finally, four outcomes include rules and guidance across critical elements of the firm-customer relationship.

-

- Products and services.

- Price and value.

- Consumer understanding.

- Consumer support.

How will the Consumer Duty impact the retail motor sector?

As a distributor of financial products, such as automotive finance and Guaranteed Asset Protection (GAP) insurance, dealerships must demonstrate how they act to deliver good customer outcomes.

The FCA will expect dealerships to:

-

- Have a robust Consumer Duty implementation plan outlining their steps to meet their obligations.

-

- Show information they get from manufacturers on financial products they distribute, enabling them to meet their obligations, specifically on products, services, price, and value.

-

- Demonstrate implementation and evidence of processes to meet the Duty for all products and services currently offered.

New regulations, production delays, supply chain disruption, market liquidity, fewer car sales and changes in customer behaviour are significant challenges affecting the automotive industry.

The changing landscape of dealerships means that improving retail profitability has never been more challenging. Market uncertainty makes it essential to manage customer expectations.

Consumer Duty is an opportunity for dealerships to build loyalty and drive profitability by exceeding their obligations. But to achieve this, dealerships must deliver a fantastic customer experience (CX).

In what way does the products and service outcome apply?

Automotive dealerships must ensure their vehicles are safe, reliable, and fit for their intended purpose. Here are examples:

Disclosure: Dealerships must disclose information about the vehicles they sell, including any known defects, accidents, or other issues that may affect their safety or performance.

Product liability: Automotive dealerships can be held liable for any injuries or damages resulting from defective vehicles they sell, including defects in their design, manufacture, or assembly.

Advertising: Car dealerships must ensure that their advertising is truthful and not misleading. They cannot make false or exaggerated claims about the safety or performance of their vehicles.

Consumer protection laws: Dealerships are subject to a range of consumer protection laws, including laws that prohibit unfair or deceptive practices, that require specific and conspicuous disclosures, and that provide consumers with certain rights and remedies.

Warranty: Automotive dealerships must honour any promises they offer on the vehicles they sell, ensuring consumers can have any covered repairs or services performed promptly and effectively.

In what way does the price and value outcome apply?

Traditionally, a car dealership will offer automotive finance as part of the vehicle sale. The uptake of vehicle ownership links directly to finance availability.

Figures from the Finance and Leasing Association show that consumer car finance increased by 9% by value and 3% by volume in 2022.

The price and value outcome requires that dealerships provide consumers with fair and transparent pricing and ensure that the product or service's value is commensurate with the price paid. Here are examples:

Pricing transparency: Car dealerships must provide consumers with clear and transparent pricing information, including the base price of the vehicle, any additional fees or charges, and the car's total cost. They must also be upfront about any discounts, promotions, or financing options available to consumers.

Fair pricing: Dealerships must ensure that the prices they charge for their vehicles are fair and reasonable. They cannot exploit consumers by charging inflated prices or engaging in price gouging. Fees charged must align with industry standards and not engage in discriminatory pricing practices.

Value for money: Automotive dealerships must ensure that their vehicles provide consumers with fair value. Vehicles must be reliable, safe, and fit for their intended purpose. Dealers must provide consumers with the features and benefits they expect based on the price paid.

Financing: Car dealerships must ensure that their financing options are fair and transparent and do not charge excessive interest rates or fees. They must provide consumers with clear information about their financing options, including the total cost of financing and the terms and conditions of the loan.

In what way does the consumer outstanding outcome apply?

The consumer understanding outcome requires firms to ensure that consumers understand the products and services they are buying, including the risks and benefits. Here are examples:

Providing clear information: Dealerships must provide consumers with clear and understandable information about the vehicles they are selling, including their features, specifications, and any associated risks. They must provide information about safety ratings, fuel efficiency, emissions, and other vital factors that may affect the value and performance of the vehicle.

Explaining financing options: Car dealerships must provide clear and transparent information about their financing options, including the total cost of financing, the interest rate, and any associated fees. They should also explain any risks or downsides related to financing options, such as balloon payments or variable interest rates.

Helping consumers make informed decisions: Dealerships must help consumers make informed decisions. They must provide guidance and advice about the vehicles based on the consumer's needs, budget, and other relevant factors to achieve this. Dealerships must also include recommendations on specific models or features and information about alternative options, such as leasing or buying used.

Providing ongoing support: Car dealerships must offer ongoing support to consumers after they purchase. Support could include guidance on maintenance and repairs and assistance with any warranty claims or other issues that may arise.

In what way does the consumer support outcome apply?

The consumer support outcome requires firms to provide ongoing support to consumers after purchasing products or services. Here are examples:

Assisting with warranties: Dealerships must provide ongoing support to consumers after purchasing a vehicle, including assistance with any warranty claims or other issues that may arise. They must provide evidence that consumers understand the terms and conditions of their warranty and provide support with any repairs or maintenance covered.

Offering maintenance and repair services: Automotive dealerships must provide maintenance and repair services to consumers through their service departments or partnerships with third-party service providers. They must guide routine maintenance and repairs and offer repairs for more complex issues.

Guidance on financing: Car dealerships must provide ongoing support to consumers who have financed their purchase, including advice on payments, interest rates, and any other aspects of their loan agreement. They must also help with refinancing or renegotiating the loan terms, if necessary.

Offering assistance with trade-ins and upgrades: Car dealerships must support consumers looking to trade in their vehicle or upgrade to a newer model. They must guide the trade-in process and offer competitive pricing for the consumer's vehicle.

How can dealerships achieve a higher standard of care?

The FCA will review Consumer Duty plans to understand a dealership's approach to embedding the regulation within the business. Putting the customer at the heart of the business means ensuring every procedure, process, and system keeps the consumer in mind.

Consumer Duty obligations require service providers to consider the customer's needs at every lifecycle. Therefore, customer journey mapping is the ideal way to see the business through its customers' eyes.

At insight6, we have the expertise to provide customer journey mapping, a valuable tool as dealerships begin to evidence their customer experience.

Feedback is essential to achieving a higher standard of care. Real-time, actionable feedback helps to deliver positive customer outcomes and will support evidencing Duty actions.

Often firms buy off-the-shelf systems to carry out their customer feedback. Unfortunately, some car dealerships can damage the customer experience (CX) in pursuit of feedback. An independent third-party assessment is best to achieve an accurate view.

Instant insight is our total feedback solution, enabling you to gather real-time feedback from your customers and team. We can work with you to understand your desired outcome and agree on the objectives. Doing so lets us explain how we plan to measure and report against these goals.

How can car dealerships increase loyalty and drive profitability?

The new regulation is an opportunity to deliver a consistently positive customer experience which will add value to dealerships over the long term. To improve the customer experience (CX), you must put the customer at the heart of the business.

The insight6 guide to Consumer Duty: Putting clients at the heart of business will show you how to build loyalty and drive profitability by exceeding your regulatory requirements with a CX approach.

Positive customer experiences make your customers happy and increase the likelihood of returning, leaving a positive online review, or recommending you to others. Car dealerships need a robust CX strategy.

By partnering with us, we can help you demonstrate and evidence your commitment to experience excellence, precisely how to deliver good customer outcomes and give you compliance confidence.

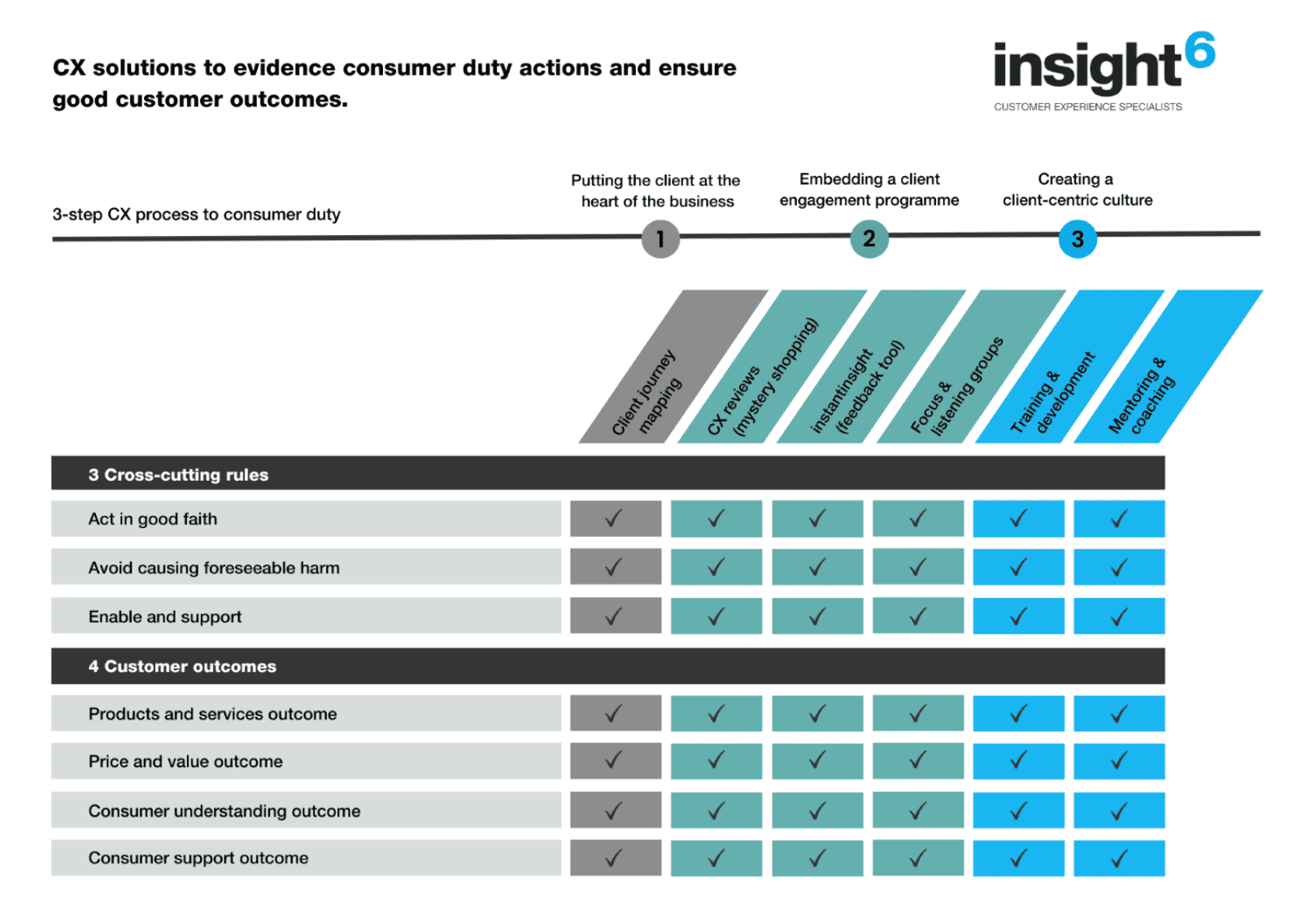

Our three-step process will help automotive dealerships address the Duty requirements across all four outcomes and give compliance confidence.

At insight6, we have developed some of the most advanced CX programmes. Our bespoke feedback tools, trained researchers and CX solutions have earned us a reputation as the partner of choice for many of the UK's largest automotive dealerships.

As well as working with hundreds of clients UK-wide, we are the only company with a network of CX Directors to support car dealerships locally. Get in touch today to see how we can transform yours.

Like what you've read? Sign up for the insight6 newsletter to keep updated with everything you need to know to improve your customer experience.